Homeowners Insurance in and around Norfolk

Norfolk, make sure your house has a strong foundation with coverage from State Farm.

Help protect your home with the right insurance for you.

Would you like to create a personalized homeowners quote?

What's More Important Than A Secure Home?

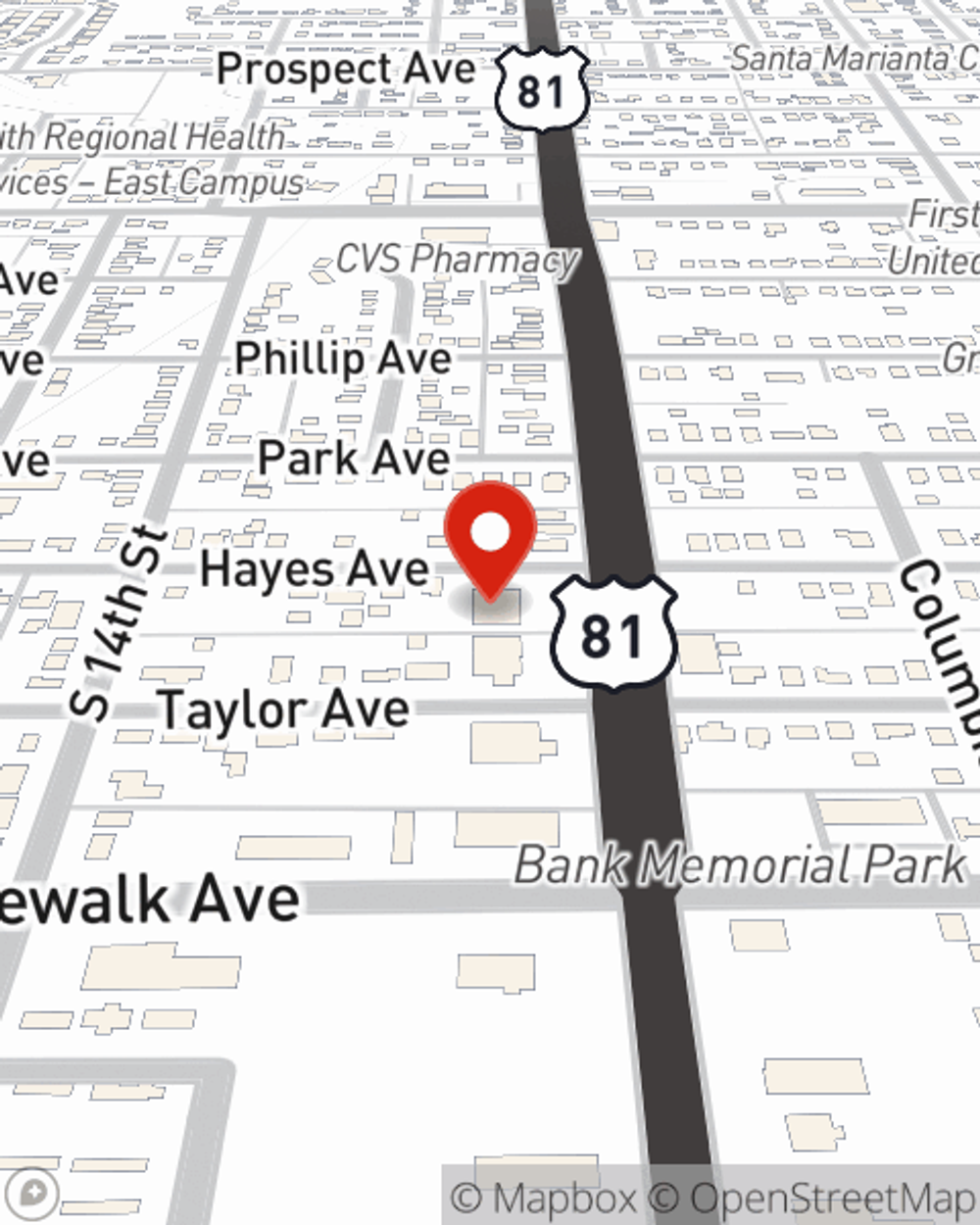

You have plenty of options when it comes to choosing a home insurance provider in Norfolk. Sorting through providers and deductibles can be overwhelming. But if you want great priced homeowners insurance, choose State Farm. Your friends and neighbors in Norfolk enjoy remarkable value and straightforward service by working with State Farm Agent Steven Willey. That’s because Steven Willey can walk you through the whole insurance process, step by step, to help ensure you have coverage for your home as well as furniture, tools, electronics, appliances, and more!

Norfolk, make sure your house has a strong foundation with coverage from State Farm.

Help protect your home with the right insurance for you.

Why Homeowners In Norfolk Choose State Farm

Homeowners coverage like this is what sets State Farm apart from the rest. Agent Steven Willey can be there whenever mishaps occur, to get your homelife back to normal. State Farm is there for you.

So contact agent Steven Willey's team for more information on State Farm's great options for protecting your home and collectibles.

Have More Questions About Homeowners Insurance?

Call Steven at (402) 316-4034 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Why cleaning your chimney is important

Why cleaning your chimney is important

Fireplaces provide warmth and ambiance in the winter, but build-up can occur in the flue and be hazardous. Learn how to keep a clean chimney.

Ways to help add value to your home

Ways to help add value to your home

Discover new ways to get the most home value, from complete home renovations to simple improvements.

Steven Willey

State Farm® Insurance AgentSimple Insights®

Why cleaning your chimney is important

Why cleaning your chimney is important

Fireplaces provide warmth and ambiance in the winter, but build-up can occur in the flue and be hazardous. Learn how to keep a clean chimney.

Ways to help add value to your home

Ways to help add value to your home

Discover new ways to get the most home value, from complete home renovations to simple improvements.